Are you sure you have the right insurance cover for your kite holidays? Read this true story and learn from our experience!

Whilst recently on holiday in El Medano, Tenerife, our son Jeremiasz was involved in a potentially serious kitesurfing accident.

We are a very experienced family of kitesurfers me & husband Pawel were watching our son from the pier.

He was attempting another big air trick when he made a mistake, his kite back stalled & he had a massively heavy landing.

Jeremiasz was winded, had intense severe middle back pain & struggled to catch his breath- so much so that later he disclosed he thought he was going to drown.

After some minutes he managed to ride downwind to a beach landing spot, about ten minutes away from launching. He was clearly injured.

We had already become alarmed as we could no longer see him kitesurfing, we finally spotted him lying flat further along the beach, with a group of people around him. Local kite school Instructors were already assessing Jeremiasz & suspected possible neck / spinal injury – an ambulance was summonsed. Jeremiasz lay wounded & in pain – whist us parents watched in horror feeling helpless.

The Ambulance soon arrived staff put an immobilization collar on Jeremiasz’s neck to restrict movement / prevent further injury. It was clear he may have damaged his neck or spine in the accident – we were petrified.

The Ambulance staff told us they needed Jeremiasz’s Passport, GHIC card & insurance documents for the hospital we urgently obtained these from our nearby accommodation.

Luckily, we got these vital documents prior to Jeremiasz being blue lighted to the nearest Emergency unit, (Las Americas Universitario Hospiten Sur)– where these documents were sought on admission, & staff advised we must ring our insurers to advise of accident immediately.

Our passports were collected & held during admission – routine practice abroad.

Jeremiasz`s wetsuit was cut off, with an IV set up for fluids – plus he was given pain killers.

Whilst Jeremiasz was urgently assessed, with bloods taken, Head / Neck CT scans, abdominal, pelvic & spinal X rays ordered, we tried to sort out the necessary insurance cover details.

We were constantly asked by the Hospital Receptionist for proof of insurance – this was a very stressful situation. I managed to call our insurers to explain situation – they asked me if we were being treated in a private or public hospital – I answered public, as assumed this is where the emergency ambulance had taken us.

Also, the insurance company help line advisor was having difficulties understanding me, as with variable reception it was hard for her to clearly understand our names & spellings.

I requested they urgently needed to confirm by e mail verification of cover, as requested by the hospital.

Whole episode complicated by low battery on phone, Insurers said they would e mail all documents to me, but with the internet connection within the hospital also being very patchy the confirmation of all details became almost impossible.

(I desperately searched for a phone charger as I had hardly any power left on my phone)

As Jeremiasz progressed through all his investigative procedures, we had a very tense time awaiting news. Eventually, some four hours later a Doctor & English-speaking interpreter advised us all scans/ X rays clear – meaning Jeremiah had no lasting damage from his fall.

We were all so relieved – Jeremiasz happy now as his collar could be removed.

As we made plans to be discharged, we still had not had our insurance details clarified.

Despite me showing staff communications includin policy schedule, pdf sent by the insurers, this was not deemed sufficient for authorization of treatment costs.

The hospital receptionist checked out their insurance recruitments – then confirmed they cannot accept my e mail from them (AXA) as proof of any insurance.

Therefore, without insurance evidence, the receptionist stated that we could not leave without paying our bill – producing a three-page list of all charges since admission total = 3271.06 Euro.

Obviously, we had to explain we did not have that amount of money to pay now – a paper was given to us to sign – basically stating we had 30 days to pay or court procedures would begin.

We signed this to get our passports back – believing we were covered for this with insurance.

We were so relieved Jeremiasz was not seriously hurt. We left & went back to our accommodation; optimistic the insurers would resolve these issues over the remaining days of our holiday.

However, on subsequent e mails I received from AXA it appears that there’s a clause stating “Travel insurance doesn’t cover treatment at private hospitals if public services are available “

– Our hearts sank as we realized the hospital, we were taken to be a private facility – how could we know that an emergency ambulance would take us there?

Without insurance cover, it meant we would have to find a way to pay this bill ourselves.

After lots of discussion, we resigned ourselves to paying this bill – the only good point about the whole episode is that Jeremiasz isn’t permanently injured – we have learnt a lot over the past 48 hours & at least the bill’s only 3000 euros (not 300,000) or more!

Meantime, we visited friends a local kite school – we chatted about our situation, & they also confirmed the hospital was indeed private.

The kite school confirmed that many people in the kite community saw Jeremiasz kite crash on local WhatsApp groups as it had gone viral – a local girl Maria got in contact with us & offered to help (Can we believe – Maria is also a member of Girls Kite Together) – she contacted the hospital on our behalf, & was able to confirm that the hospital can treat people under a public services contract clause.

After negotiations by Maria, it appears now the hospital has agreed to confirm this to our insurers & all will be paid by them – what a fantastic ending to our story.

Huge thanks to the amazing Angel that is Maria – we never even got to meet you personally to thank you, as it was time to return to the airport to fly home. The power of Girls Kite Together – always looking out for each other!

We would also like to thank all those who helped us – so many people involved, who ensured our situation had a happy ending – especially the Red Cross Rescue Team & PKS Tenerife Team (instructors gave Jeremiasz first aid on the beach plus kept our gear safely)

With hindsight, we have learnt the following & wish to share our recommendations for a safe, happy, stress-free holiday:

- Downloading / Screenshotting your insurance policy (Taking a paper copy may be easier than finding a printer when away)

- If you travel on your own have all necessary details written out easily for someone to go through

- Emergency insurance contact number saved on phone with your insurance number.

- Possibly have insurer claim forms already saved or printed.

- Always carry a power bank for your phone in case of emergencies

- Making sure any injuries treated abroad isn’t at a private facility – check with any ambulance/ transport.

- GHIC cards only cover basic emergencies (Heart attacks, stroke, breathing difficulties, broken bones – but NOT related to sports activities

- Have holiday accommodation address and contact details in hand!

- Remember as well that not everyone will speak English!

IMPORTANT

Does travel insurance cover private medical treatment?

A common misunderstanding with travel insurance cover relates to medical expenses; many holidaymakers do not realise that the majority of travel insurance policies will not offer cover for medical treatment at private hospitals, they only cover the cost of treatment in a public or state hospital.

RECOMMENADTION

For many years we are using Sports Cover Direct which we highly recommend as sports and travel insurer.

TIP

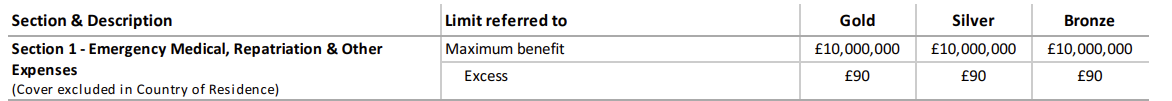

*Increasing insurance premium not always increase benefit levels or minimize excess fee, consider this.

*Some insurers like Sport Cover Direct advise: For travel within Europe, we advise you to take a valid European Health Insurance Card (EHIC) or Global Health Insurance Card (GHIC). Should you have an accident and use the EHIC / GHIC we will waive the Medical Excess of £90.